Modern Toyota Of Asheboro Things To Know Before You Buy

Modern Toyota Of Asheboro Things To Know Before You Buy

Blog Article

Modern Toyota Of Asheboro - Truths

Table of ContentsSome Known Questions About Modern Toyota Of Asheboro.Modern Toyota Of Asheboro Fundamentals ExplainedThe Ultimate Guide To Modern Toyota Of AsheboroFacts About Modern Toyota Of Asheboro RevealedWhat Does Modern Toyota Of Asheboro Mean?

Here are a few methods to conquer this obstacle: Replace the title: Get in touch with your state's department of car to ask for a brand-new one. Write a proof of purchase: If your automobile was made before your state started issuing vehicle titles, you may be able to make use of a DMV kind or your own expense of sale rather.Look right into various other titling alternatives: Some states allow you to obtain a title for an automobile that's deserted or has certain kinds of liens against it. When you trade in your car that still has a lending on it, the worth of trading in the vehicle will certainly go in the direction of repaying your balance.

If there are still staying settlements that need to be made, your dealership commonly rolls over your existing loan right into an additional when you finance a new or secondhand auto. It is usually a better idea to consolidate your financial obligation when going this path as you'll end up paying a lot more with different car loans

Indicators on Modern Toyota Of Asheboro You Should Know

The supplier may want to surrender the continuing to be equilibrium right into a new auto loan. Simply put, you'll still be the one paying it. Evaluation your paperwork to confirm that the dealership really did not simply add the $5,000 to the new vehicle loan, deduct that from your down payment or perhaps do both.

Here's what to do if your vehicle has adverse equity: Read the dealership's agreement to find out exactly how adverse equity is treated with trade-ins. If you roll the adverse equity into your brand-new cars and truck's financing, pick a shorter finance term to prevent paying even more rate of interest on the old financial debt.

Car dealerships are either: 1) people who acquire and sell automobiles, or 2) the location where they sell/buy cars (" cars and truck dealership's" may be better yet I do not understand exactly how to write it when I want to refer to even more than one of suppliers'?). Car dealerships are the exact same as car dealers # 2.

The smart Trick of Modern Toyota Of Asheboro That Nobody is Talking About

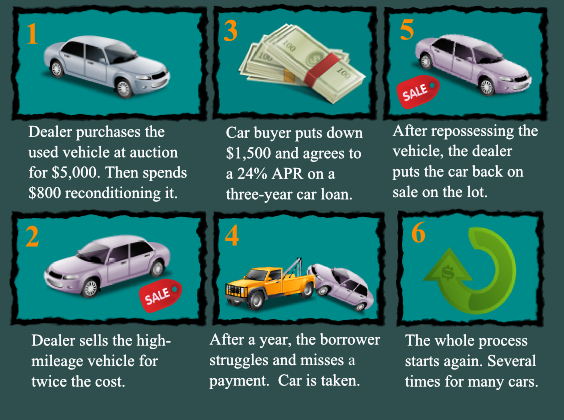

Having difficulty securing an auto funding to purchase a cars and truck? "Acquire right here, pay right here" car dealerships supply internal funding, normally to borrowers with negative credit. While this course is worth considering if your credit rating isn't in wonderful form, there are some risks to consider. When you sign a contract to acquire an auto with a traditional car dealer, it passes the contract on a car lender, which gives a finance for the purchase.

BHPH dealerships focus on dealing with individuals who have negative credit or no credit report in all. As a result, they can give an opportunity that some borrowers will have a difficult time locating anywhere else. Prior to you think about a BHPH dealership, however, it is very important to take into consideration both the benefits and downsides of doing so.

Most legitimate auto lenders report your payment activity to all 3 credit report coverage companies (Experian, TransUnion, and Equifax), which can aid improve your credit report rating if you're making regular on-time payments. But that's not constantly the case with BHPH car dealerships, particularly if it's a little outfit for which the prices of reporting would certainly be too high.

The Only Guide to Modern Toyota Of Asheboro

Make every effort to remain on top of the funding and stay clear of breaking your liked one's count on. Cooperative credit union typically supply reduced costs and car loan rates and may be much more open to providing to people with bad credit score. If you're already a participant of a credit score union, inquire about your eligibility.

Obtaining accepted for a car finance with negative credit history or no credit score background at all isn't easy, yet it is practical. Purchase here, pay below car dealerships offer financing to individuals with less-than-stellar debt, however the disadvantages tend to outweigh the advantages.

So, you have an interest in buying a used automobile. Franchised car dealerships are the only suppliers that can offer you a maker accredited secondhand used automobile. Necessarily, a franchised car dealership is a car seller that offers new and previously owned autos for vehicle makers such as Ford, General Motors, Honda, and other major brand names.

Some Known Details About Modern Toyota Of Asheboro

Independent dealerships will certainly offer you any type of type of used cars and truck, despite that made it. As mentioned, they might market accredited previously owned made use of autos as well, however these are backed by service warranty insurance coverage programs. That doesn't imply there is anything incorrect with the cars. There isn't. It simply implies they are going to have different security than manufacturer certified secondhand automobiles.

However they are trying to make a dollar. Their profits are normally going to precede since they have to in order to pay their employees and themselves.

Report this page